Offshore Company Formation Demystified: Your Roadmap to Success

Wiki Article

Every Little Thing You Need to Find Out About Offshore Firm Development

Navigating the intricacies of overseas firm formation can be an overwhelming task for several individuals and services wanting to broaden their procedures worldwide. The attraction of tax obligation benefits, asset defense, and enhanced personal privacy frequently draws rate of interest towards establishing offshore entities. The intricate web of legal demands, regulatory structures, and financial considerations can pose substantial difficulties. Comprehending the subtleties of offshore firm development is critical for making notified choices in a globalized company landscape. By untangling the layers of benefits, obstacles, steps, tax effects, and compliance responsibilities associated with offshore company formation, one can obtain a detailed insight into this diverse subject.Advantages of Offshore Firm Development

The advantages of establishing an offshore business are complex and can significantly benefit companies and individuals seeking calculated economic preparation. One vital benefit is the possibility for tax obligation optimization. Offshore firms are often subject to favorable tax regulations, permitting decreased tax liabilities and enhanced profits. Additionally, establishing up an overseas firm can supply possession security by separating personal properties from organization responsibilities. This splitting up can secure personal wealth in case of lawful conflicts or financial challenges within the business.

In addition, overseas companies can promote worldwide company operations by giving access to global markets, expanding profits streams, and enhancing organization credibility on a global scale. By establishing an overseas presence, organizations can touch into brand-new opportunities for development and growth past their domestic boundaries.

Typical Difficulties Dealt With

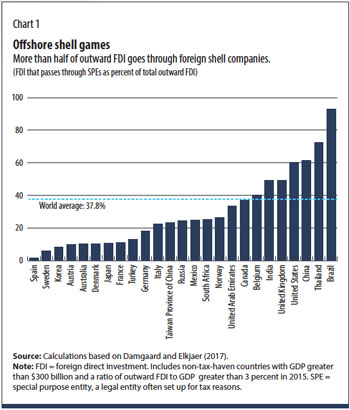

In spite of the countless benefits linked with offshore firm formation, organizations and individuals usually experience usual challenges that can influence their operations and decision-making processes. Browsing varying legal structures, tax legislations, and reporting criteria across various territories can be time-consuming and complicated.Another typical difficulty is the threat of reputational damage. Offshore business are occasionally viewed with uncertainty as a result of concerns regarding tax obligation evasion, cash laundering, and lack of transparency. Handling and minimizing these perceptions can be difficult, especially in a significantly looked at global business atmosphere.

Furthermore, establishing and preserving reliable interaction and oversight with offshore procedures can be testing due to geographical distances, cultural differences, and time zone variations. This can cause misconceptions, hold-ups in decision-making, and problems in checking the efficiency of overseas entities. Getting over these obstacles calls for mindful preparation, attentive threat monitoring, and a thorough understanding of the regulatory landscape in offshore territories.

Actions to Kind an Offshore Business

Establishing an overseas firm involves a collection of legitimately compliant and tactical actions to ensure a effective and smooth development procedure. The first step is to pick the overseas jurisdiction that best fits your organization demands. It is important to conform with recurring coverage and compliance requirements to preserve the excellent standing of the overseas firm.Tax Ramifications and Factors To Consider

Purposefully browsing tax obligation implications is essential when developing an overseas firm. One of the primary reasons individuals or services choose overseas company development is to take advantage of tax obligation advantages. However, it is important to conform and comprehend with both the tax legislations of the offshore jurisdiction and those of the home nation to ensure legal tax obligation optimization.Offshore companies are often based on positive tax regimes, such as reduced or absolutely no business tax rates, exceptions on specific kinds of income, or tax obligation deferral choices. While these benefits can result in substantial cost savings, it is essential to structure the offshore business in a manner that aligns with tax obligation laws to stay clear of possible legal issues.

In addition, it is crucial to think about the implications of Controlled Foreign Firm (CFC) guidelines, Transfer Rates guidelines, and other global tax regulations that pop over to these guys may influence the tax therapy of an offshore firm. Consulting from tax obligation professionals or experts with experience in offshore taxes can help browse these complexities and make sure compliance with appropriate tax obligation policies.

Managing Compliance and Rules

Navigating with the detailed web of conformity needs and guidelines is vital for making certain the smooth operation of an offshore firm, particularly due to tax obligation implications and considerations. Offshore territories often have certain regulations regulating the formation and operation of business to avoid money laundering, tax evasion, and various other immoral activities. It is important for business to remain abreast of these laws to avoid significant fines, lawful concerns, or also the opportunity of being closed down.To manage compliance efficiently, offshore business must select educated specialists that understand the international standards and local laws. These experts can her explanation help in establishing proper governance frameworks, keeping exact economic documents, and sending needed reports to regulatory authorities. Regular audits and reviews need to be performed to make certain recurring conformity with all appropriate legislations and policies.

Furthermore, remaining educated regarding modifications in regulations more info here and adapting techniques appropriately is vital for lasting success. Failing to abide by policies can taint the online reputation of the firm and cause serious consequences, highlighting the importance of focusing on compliance within the overseas business's operational framework.

Conclusion

To conclude, offshore firm development provides various benefits, but also comes with challenges such as tax obligation effects and conformity demands - offshore company formation. By adhering to the required actions and taking into consideration all facets of creating an offshore company, companies can make the most of international possibilities while taking care of dangers efficiently. It is essential to stay educated regarding policies and remain certified to make sure the success and durability of the overseas organization ventureBy deciphering the layers of benefits, difficulties, steps, tax obligation implications, and conformity obligations linked with offshore firm formation, one can obtain a detailed insight right into this multifaceted subject.

Offshore firms are typically subject to favorable tax obligation regulations, enabling for lowered tax responsibilities and increased revenues. One of the primary reasons people or businesses choose for overseas company formation is to profit from tax advantages. Offshore territories often have certain regulations regulating the development and procedure of companies to avoid cash laundering, tax obligation evasion, and other illegal tasks.In verdict, offshore business development supplies various benefits, however additionally comes with obstacles such as tax ramifications and conformity needs.

Report this wiki page